For the last 20+ years, the European life insurance and pension industry has struggled to generate market growth and shareholder returns. The industry average shareholder returns (since the year 2000) were just 0.8% per annum (p.a.) (see note 1), and assets under management (AUM) only mirror equity market growth. In comparison, other retail sectors such as leisure goods and healthcare provision have outperformed and delivered 7.4% and 4.8% p.a. returns (see note 2) respectively, over the same period by implementing customer-centric retail business models.

In contrast, the life insurance industry has persisted with existing business models, selling outdated products through traditional channels with very little end-client focus or engagement and a high-cost base. New competitors in wealth and asset management have grown rapidly, capturing the most profitable customers and building lucrative businesses.

However, there is a massive opportunity for insurers to drive transformative growth and new value creation. According to our analysis, the market cap of the European life and pension industry could increase by €400 billion over the next five years, more than doubling (see note 3). We believe that insurers could be poised for long-term growth by rethinking their core value proposition around solving customers' most pressing problems.

According to Oliver Wyman analysis, the market cap of the European life and pension industry could increase by €400 billion over the next five years, more than doubling

According to Oliver Wyman analysis, the market cap of the European life and pension industry could increase by €400 billion over the next five years, more than doubling

Time to deliver on shareholder value

How can life insurers capitalize on this opportunity? In our report, Reinventing the European Life Insurance Industry, we show how shareholders can drive transformative growth by putting customers first. We set out market insights, industry analysis, and three key operating model changes insurers can take to meet evolving customer needs and drive new business value creation. For those insurers that embrace the challenge — of fortifying both financial consolidation and customer-centric growth businesses — success is dependent on the delivery of simultaneous transformations and a complete reform of their conglomerate structure. Below is an excerpt and view our full report here.

Focus on clients to build long-term shareholder value

The retirement savings and income market presents an opportunity for insurers to build valuable growth businesses, but most have failed in two important ways. First, disruptors, wealth and asset managers and private equity players, have outperformed insurers, capturing most of the new opportunity. Private equity has been a catalyst and force for change both in terms of driving consolidation and iterating and reinventing business models. Second, insurers’ propositions are not sufficiently profitable; cost bases have not fallen as fast as margins, and client engagement is limited to product servicing. In the insurance industry, way too often, we view the marketplace through the lens of our products — “we’re in the life insurance business”— rather than through the customer’s jobs lens — “I have to care for and protect my family if something happens to me.” Too often, innovation focuses on functional improvements to the product but fails to facilitate the real progress consumers are looking for. While this mindset can be widely successful, it fails to deliver on market-creating innovation, which is critical for the industry to unlock growth (and to survive) in the coming decade.

Insurers need to evolve their mindset by shifting away from selling products and moving toward solving problems

Insurers need to evolve their mindset by shifting away from selling products and moving toward solving problems

Adopting more customer-centric approaches requires insurers to evolve their mindset by shifting away from selling products and moving toward solving problems. And the key to unlocking growth is understanding the customer’s highest priority in a specific situation, the “job to be done.” What does the customer want to accomplish and what problem do they need a solution for? Building services around clients’ “jobs to be done” significantly improves the attractiveness of propositions and reduces the marginal cost of delivering them. Other retail and digital industries exemplify how a digitally-enabled proposition with high levels of customer engagement can help constrain costs within even the tightest margins and deliver attractive profits.

Action: Activating a CustomerFirst mindset will drive both short- and long-term value creation. Insurers need to realign corporate strategy with investments that are deeply tied to customers’ needs.

Radical business model transformation is necessary to profitably capture the retirement growth opportunity

Insurers are faced with a stark choice of focusing on financial consolidation or customer-centric growth — however both are critical to shareholder returns

Insurers are faced with a stark choice of focusing on financial consolidation or customer-centric growth — however both are critical to shareholder returns

Shareholders are aware of the challenges plaguing the European life and pensions sector, and they are captured in current market valuations. Current market valuations of insurers are low; they are consistent with the existing portfolio and do not incorporate option value for the development of a new customer-centric growth business. Insurers are faced with a stark choice of focusing on financial consolidation or customer-centric growth — however both are critical to shareholder returns. The upside of success is massive. We estimate the value of existing shareholder equity in the European life and pensions sector could more than double over the next five years (see note 4). This is equivalent to an additional €400 billion (see note 3) of shareholder value, shared across companies that successfully execute the transformation. By thinking and managing in a CustomerFirst way, insurers can reposition themselves as active growth players with an increasing share of customer attention.

Action: A successful transformation program needs to work across all levers of change (including leadership, organization, skill, mindset, and ways of working), and with a view that small steps, systematically taken, lead to big opportunities.

1. Total shareholder return is calculated as compound annual growth over an investment in a representative set of life insurance companies held over an investment period from 01 January 1999 until 06 March 2023. Dividends are assumed to be reinvested. Calculations do not account for transaction or reinvestment fees.

Other retail industries have been much better at building valuable customer relationships

Compared to other retail sectors selling both financial and non-financial products, European life shareholder returns have been particularly poor. Life insurers have delivered a lower return than banks over a period encompassing the global financial crisis, massive state investment, and 14 years of quantitative easing. The return is significantly lower than that of non-life and healthcare insurers, which are also businesses that experience similar difficulties in client engagement and have high levels of regulation. The biggest takeaways come from the personal and leisure goods sectors, which have dramatically outperformed the life industry with customer-centric retail business models.

-multiple-for-European-life-insurers-and-asset-managers.png)

Action: By focusing on customer needs, insurers can identify gaps that, when addressed, create outsized value for customers and shareholders. Insurers need to understand beyond the “what” of customer characteristics (for example, age, demographic, psychographic information) — and get to the “why” of their customers’ motivations or what the consumer wants to accomplish. Building a truly differentiated solution begins with understanding the full range of customer needs — not only functional, which are often insurers’ focus, but also social and emotional.

Emerging examples of customer-led value creation

Across Europe, life insurers have faced growth challenges with their current business models and are at risk of being rendered obsolete by competition and disruptors. Many of the faster growing investment platform businesses have begun to pivot towards a CustomerFirst approach, which can produce valuation multiples that are generally much higher than traditional businesses. The exhibit below shows that the forward price-to-earnings ratios (P/E) of traditional life insurers are now significantly behind those of asset managers and retail focused investment platform businesses.

Market values suggest a lack of belief or conviction that insurers can transform to a valuable customer-centric growth model. Strong evidence is needed to award insurers with a re-rating that moves in the direction of other consumer industries. However, even small movements can deliver large shareholder returns, emphasizing the value of pivoting to a customerfirst approach.

Twenty years ago, the European life industry was strongly differentiated from other asset management businesses by its ability to leverage its balance sheet and offer guarantees and innovative products that were attractive to intermediaries. This capability declined as long-term interest rates and margins fell, leaving insurers and asset management specialists with a very similar product set. If the recent interest rate increases are sustained, then insurers will be able to offer differentiating guarantees, but they must not believe this will save their business model.

Action: It will certainly provide attractive building blocks for the broader proposition, but the world and insurance consumers have evolved, necessitating a more client-led and product-led approach.

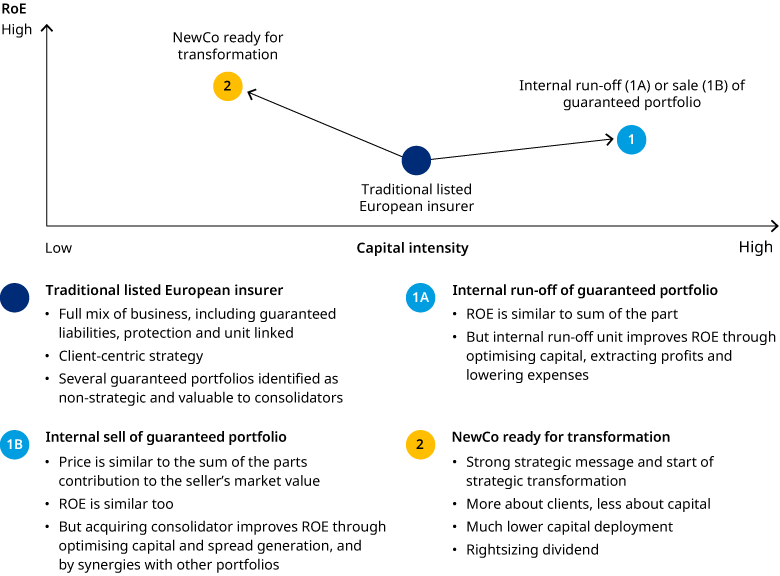

Fund the transformation

It will be expensive to build new customer-centric businesses that capitalize on the retirement opportunities, and there is not much option value in the share price. This makes it difficult to justify the investment needed to compete with disruptors and investment and wealth providers. However, insurers can derive funding from the disposal of a strategically obsolete portfolios to a consolidator, either through a sale or a funded reinsurance deal. Consider the example below of a traditional insurer moving towards a capital-light customer-centric model, with the transformation funded by the sale of a portfolio of capital-intensive guaranteed businesses.

The conglomerate challenge

We first recognize that most life and pensions companies are conglomerates of businesses with very different growth and income generation opportunities. Insurers need to move beyond the opaque conglomerate. The traditional life business should be recognized as a financial conglomerate, spanning several businesses with different abilities to support shareholder income and value growth. In general, shareholders find it very difficult to assess the value of a conglomerate and conversely, conglomerates find it difficult to demonstrate their value to shareholders.

Action: In some cases, simplifying the structure or reporting will be sufficient, but in most a radical restructuring is required. Insurers need to be able to see and understand each of these businesses separately and then assess the synergies, diversification benefits, and overheads across the entire group.

Structure around your growth business

Refocusing on growth, ageing populations and privatization can bring huge growth opportunities. Innovation and experimentation are required to build the future propositions that will deliver wins for all stakeholders. Companies can strategically identify opportunities by capitalizing on their "key assets" or “crown jewels,” that are unique, valuable, and hard to replicate. This is how companies gain a competitive advantage. It is difficult to manage a mature, asset-intensive business alongside a high-growth, customer-centric business. It requires a decisive pivot of management, stakeholder conviction, and investment focus towards new value sources, including different organization structures, investment mechanisms and capital structures — all designed to target business-specific levers of value creation. Insurers and their management teams need to agree on what really matters over the short- and long-term, and acknowledge the journey as a business transformation, not merely a digital one. They need to craft the right portfolio of bets and appropriately allocate the right management attention and resources. Do I have the right balance between business reinvention and growth bets?

Action: The first step is to identify growth businesses across the portfolio and to mobilize and develop them.

Get started

European life and pensions conglomerates have a stark choice between reinventing themselves as customer-centric growth businesses or drifting into becoming a manager of legacy run-off portfolios. Many European companies are migrating towards either financial consolidation or customer-centric growth businesses — however both are critical to shareholder returns.

Insurance consumers have many more choices to fulfill their needs, and they are open to both established and de novo brands that represent progress. Power has shifted from the supply side, incumbents in well-defined industries, to the demand side, people with problems they seek to solve, to fulfill, driven by time and convenience. To drive both short and long-term value creation, insurers need to deepen relationships with customers, activate a CustomerFirst mindset, and realign corporate strategy with investments that are deeply tied to customers’ needs.

Insurers need to identify channels that supplement customers’ lives with solutions that either address real struggles or replace inadequate options. Building a truly differentiated solution for customers begins with focusing not only on functional dimensions (such as financial terms, accessibility, reliability, performance, and security), but also on the full range of social and emotional dimensions.

By thinking and managing in a CustomerFirst way, insurers can reposition themselves as active growth players with an increasing share of customer attention. A successful transformation program needs to work across all levers of change (including leadership, organization, skill, mindset, and ways of working), and with a view that small steps, systematically taken, lead to big opportunities.

At Oliver Wyman, we have been helping clients to activate a CustomerFirst mindset and invoke key operating model changes to drive transformative growth. We can support your team with structuring large scale transformation programs and building new value creation — both through building new customer-centric models and by structuring portfolio transactions.

The time to get started is now.

Notes

1. Listed European firms, allowing for reinvestment of dividends. See Exhibit 7 on page 11.

2. Oliver Wyman analysis.

3. Oliver Wyman analysis. Split approximately €100 billion for the Financial Consolidator businesses and €300 billion for Consumer Growth businesses.

4. For the Financial Consolidator market this is estimated by projecting deal flow over five years in both the closed life and pension risk transfer (PRT) markets and applying current levels of shareholder valuations from both the listed and private markets. For Consumer Growth businesses it has been estimated based on achievable levels of profit growth over the next five years and the current dividend yields PE ratios of the adjacent asset management market.